A Life Less Exhausting

A Healthy Mid-Journey Breather For Electric Mobility.

Storm clouds have appeared from various directions. The auto business is finding itself in difficult to navigate waters. Following the rhetoric of some of the established European automakers, electric cars are no longer flying off the shelves and sales are underwhelming compared to expectations. The bottlenecks in the supply chains have disappeared and instead the focus has turned to bloated inventories at dealerships. Plug-in autos, with a partially- or fully-electric drivetrain and with the ability to recharge from the grid, represented almost 25% of total sales in Europe last year, up only a meager 5% in market shares from two years ago.

Some say that the current soft patch is following the usual market development. The segments of innovators and early adopters, fancying technology and with a high willingness to pay for something new, might have already been exploited. These customers potentially are all driving electric already. The next segment of the so-called early majority puts more emphasis on product value and functionality. The premium pricing and perceived gaps in charging infrastructure influence the decision making and lead to more cautiousness. This makes it a tougher sell for the auto makers. Here, experience from peers with new technology, including friends and family, becomes a decisive element in gaining trust and shaping the market development. Charging infrastructure seems to be developing faster than the public realizes, and the competition will eventually also reduce the confusion coming from the great variety of operators and tariffs.

With hindsight, some also say that the pandemic around 2020 and 2021 had created a hype-environment fueled by a broader sustainability focus within society and the substantial subsidies provided by the government. This hype largely reversed in 2022 and 2023, mirrored in the scaling back of support measures. Ultimately, this reset is a healthy development as the technology has matured sufficiently and would no longer require financial support. It is mainly the politicians’ inherent bias for over activism combined with solid lobbying that keeps the subsidies flowing.

A closer look at China offers some clues about the things to come. The Chinese auto market has moved beyond the early adopters and sales of plug-ins largely come from the broader, and more innovation-pragmatic majority of buyers. Plug-ins represented 35% of total sales last year, topping out at 40% in December. China dominates the auto business. It accounts for roughly one in three cars sold globally, and more than one in two plug-in cars sold globally. Importantly, most support measures and subsidies have been scaled back over the past years. The strong momentum in China suggests that softness in plug-in sales in parts is a European perspective.

The growth of the domestic auto market coincided with the structural shift towards electrification. Many new entrant manufacturers began from scratch with a focus on electric drivetrains. The playing field had been levied from the beginning somewhat. Electric mobility changes the auto business in many aspects, bringing new manufacturing methods, a fully digital driver and passenger experience, and a shift to more online-driven selling. Some Chinese auto makers master these challenges well and offer electric cars that are on par cost and price-wise with their combustion engine peers. Moreover, new entrants tend to be swifter in development and adaptation to market needs, simply out of the necessity to create cash flows, unable to rest on flowing profits from any established business as most incumbents can. The pragmatism and product value considerations of the majority buyers are addressed. Chinese auto makers are ahead of the curve, and this lead manifests itself in the struggles Western auto makers face in selling their products in China. Their products cannot compete in costs and convenience.

China’s dominance in electric car manufacturing explains its dominance in battery making. This business surprisingly moved in the opposite direction than commonly expected. Initially, the thinking was that the growth in plug-in sales would mean lasting shortages along the supply chain from battery metals mining to battery cell production, leading to persistently elevated prices. Instead, battery metals such as lithium, nickel or cobalt witnessed a sell-off with prices dropping up to 80% last year. Battery cell prices are down to around $70 per kilowatt hour, with the softness of the Chinese currency adding to the weakness. Battery cell manufacturing seems to be a highly competitive business with intense pressure on margins and pricing. These dynamics are fierce for companies but ultimately beneficial for consumers, as production costs and product prices decline. Cheaper batteries in part closes the price gap of electric cars to their combustion engine peers.

Other trends witnessed in China might be more worrying for Western automakers. Inventories are ample, competition fierce and price discounts a common strategy to boost sales. The aggressive investments over the past years seem to result in overcapacities. Even more worryingly, this slack appeared even though domestic sales climbed to record levels last year. Given the demographic shift, a stagnant population, persistent economic challenges and depressed consumer sentiment, auto sales are more likely to slow down than to keep growing at their recent pace. Trade becomes one of valves to vent the pressure. Chinese auto exports multiplied over the past three years, in part on the back of Western companies setting up manufacturing in China, mostly however on the back of increasing global demand for products that are attractive technology-wise and price-wise for buyers.

These trends are potentially exemplary for the economic situation overall. China has become a so-called deflationary force. Excess capacities have appeared across different parts of its economy. Exports are growing, from autos, to solar modules, steel, and various other products, driven less by strong foreign demand but more by ample domestic supply. Meanwhile, both in Europe and North America policy making such as the “Green Deal” package or the “Inflation Reduction Act” supports investments in domestic manufacturing, which ultimately pose threats of resulting in overcapacities too. With the pandemic the pendulum had sharply swung into shortages and goods inflation, and this pendulum seems now to swing in the other direction more lastingly. There are of course additional factors that influence inflation dynamics. That said, economics is all about cycles and some underlying cycles last longer than those determined by central banks and their interest rate policies.

This decade will very likely see a profound shift towards electric mobility. Technology continues to evolve, and scale continues to build. These dynamics should bring a growing offering of plug-in autos, with ever greater convenience in driving ranges and charging times, produced at ever lower costs as the manufacturing adjusts to the possibilities offered by battery electric drivetrains. Towards 2030 most buyers should opt for a plug-in because it fits the individual needs more conveniently. Today’s difficult to navigate waters and fierce business dynamics could bring some industry consolidation that is painful for some but overall healthy longer term. Investors with some interest in this theme likely noticed these headwinds when studying their portfolios. The ongoing margin erosion pressured stock prices of auto makers and auto suppliers. Despite the long-term nature of its underlying structural trends, thematic investing tends to be tactical investing. Most investors are not patient enough to sail through rougher waters stirred up by temporary cyclical headwinds. Observing the rougher waters from the sidelines is an adequate investment strategy for the time being.

Philippe Honegger, Head of Investment Advisory at Bank Julius Baer Monaco, points out: “Future mobility plays a central role in our investment value chain and allocation process. Accounting for around a third of global CO2 emissions from the end-use sector, the transport industry has a major role to play in the decarbonization of the economy. Regulatory, economic, and societal forces will serve as main drivers. From the investors point of view, the subject has the great advantage of offering a wide range of possibilities to be part of the journey as it is composed of hundreds of companies and not restricted to EV automakers only.”

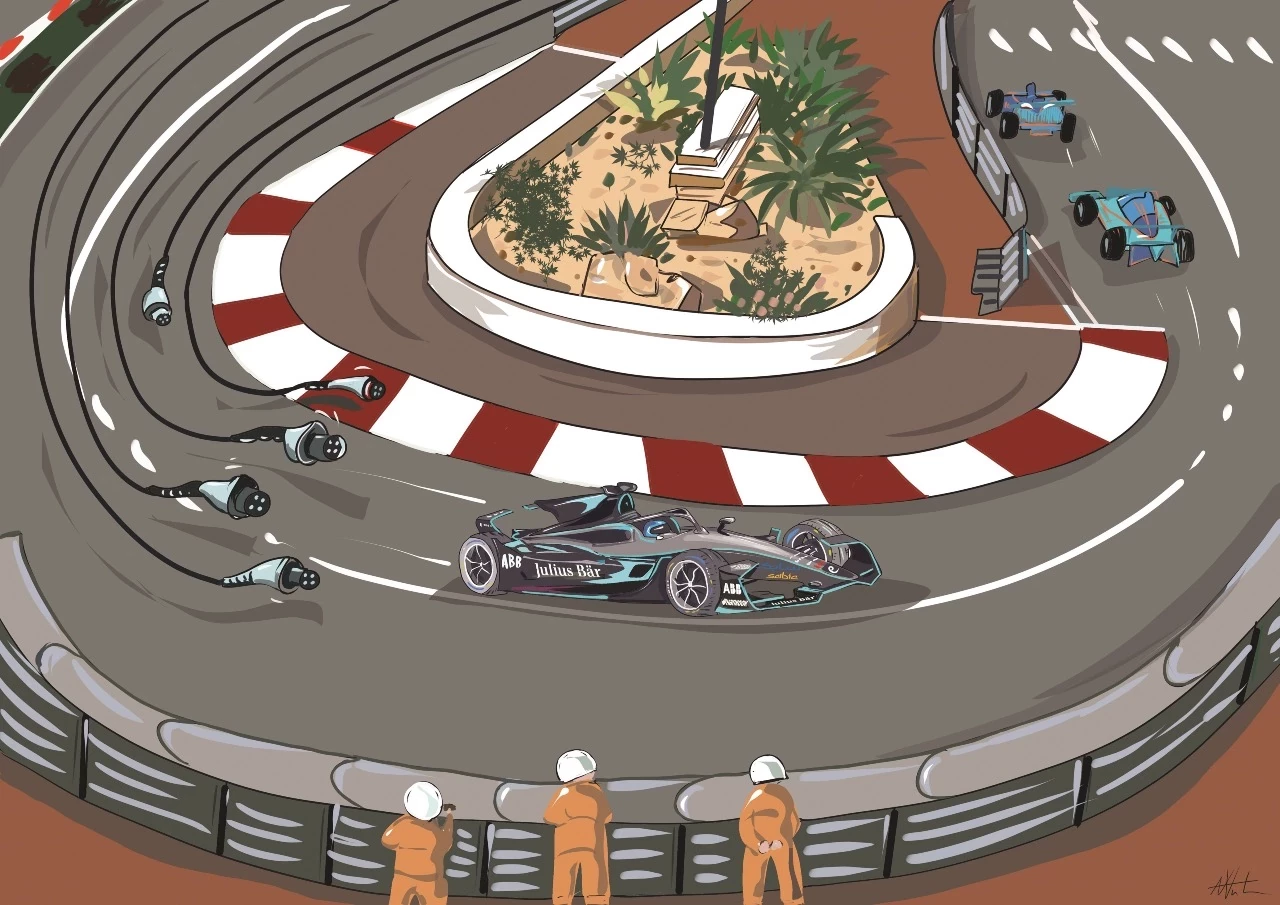

"As a former Formula E driver and a resident of Monaco, I am inspired by the Principality’s dedication to environmental protection and sustainable mobility. Monaco’s commitment to clean energy and innovative solutions sets a remarkable example for the world.

I believe that prioritizing effective and clean mobility is not just a choice, but a responsibility we owe to our planet and to future generations. I am proud to be part of a community that values sustainability and takes active steps towards a greener future."

Racing champion and a passionate sustainability advocate Bruno Senna on Monaco efforts in developing mobility of the future.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of The Monegasque™.

Disclosure: The Monegasque™ enhances the editing process with the help of carefully selected AI tools. These tools provide valuable support without taking over the editing process completely, ensuring that the final product is the result of human creativity and expertise augmented by the benefits of enhanced technology. This article is protected under the copyright of The Monegasque™. Unauthorized reprinting, republishing, or rewriting of this content is strictly prohibited without explicit permission from The Monegasque™. Quotations from this material are permissible provided that a direct link to the full article on The Monegasque™ is included.